Superannuation & SMSF Adviser

Massey Financial Advice

At Massey Financial Advice, we help clients across Brisbane make informed decisions about their superannuation, whether that means enhancing their current fund, moving to a different fund, or exploring the suitability of an SMSF. Our role is to simplify the complex and provide advice that’s tailored to your goals, not driven by products.

Understanding Superannuation and SMSFs

Superannuation is one of the most powerful tools Australians have to build long-term wealth and prepare for a comfortable retirement. While many choose traditional super funds, others are seeking more control and flexibility over how their retirement savings are managed. That’s where a Self Managed Superannuation Fund (SMSF) can be an attractive option – but it’s not for everyone.

Superannuation is a long-term savings structure designed to help you accumulate wealth for retirement. It offers tax advantages and compounding growth potential over time. Most Australians have their super invested in a retail or industry fund, where investment decisions are handled by professional fund managers.

A Self Managed Superannuation Fund (SMSF), on the other hand, allows you to take direct control. You become the trustee and make decisions about how the fund is managed and where the money is invested. This might include direct shares, managed funds, commercial property, or even specialised assets. With this added control comes greater responsibility – you must manage the fund in line with strict legal and regulatory obligations.

Is an SMSF Right for You?

SMSFs are not a one-size-fits-all solution. They tend to suit individuals or families who:

- Have a higher super balance (generally over $300,000, but more is typically better)

- Want more control over investment decisions

- Are confident managing financial matters or have trusted advisers supporting them

- Wish to invest in specific assets such as property or direct equities

However, SMSFs aren’t suitable for everyone. They come with administrative and compliance responsibilities that may not appeal to those with limited time, lower balances, or a preference for hands-off investing. That’s why understanding whether an SMSF aligns with your financial capacity, interest level, and long-term goals is a crucial part of the planning process.

Benefits of SMSFs

SMSFs offer a number of benefits that appeal to experienced or engaged investors, including:

- Greater control over how and where your super is invested.

- Tailored investment strategies, including direct shares and direct property.

- Tax planning flexibility for managing income and capital gains within the fund.

- Estate planning advantages, such as more control over how benefits are distributed.

- Cost efficiency at higher balances, where fixed fees can offer value.

These benefits can be compelling — but they also come with obligations that require careful consideration.

Responsibilities and Compliance

Managing an SMSF means taking on the role of trustee, which comes with strict responsibilities. You must:

- Keep accurate records and meet annual reporting obligations

- Ensure your fund complies with superannuation laws and tax rules

- Engage an independent auditor each year to review your fund’s compliance

- Understand that mistakes or breaches can result in penalties or tax consequences

While this may sound daunting, working with an experienced financial adviser can help ease the burden and ensure your SMSF remains compliant and on track.

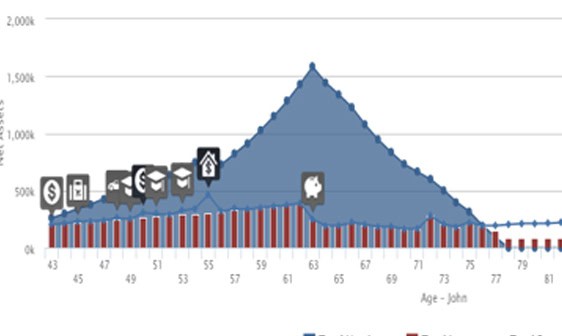

They are currently aged 43 and 41 respectively, plan to work until age 63, and according to Australian averages they can expect to live until 82 and 86.

The blue shaded area to the left of the peak shows how they are building assets while they are working. The icons and rising expenditure line show various expenses during this time which include…

- Overseas holidays every 3 years

- Replacement car every 5 years

- Private high school fees for 3 children from John’s age 49

- Purchasing a boat at age 50

- Home renovations at age 55

The spot where the blue net assets line meets the horizontal axis indicates when John and Sue will run out of money (around age 78). This gives them the opportunity to adjust their planning to achieve a different outcome. For example they could…

- Reduce their expenditure by changing or postponing some goals

- Become more disciplined with their spending (now and in the future)

- Modify their savings levels

- Adjust their investment risk

With this information, John and Sue can make decisions that help them prepare for retirement, balanced with current spending and life experiences.

Imagine having this financial modelling for your income, expenditure, and assets. Like John and Sue, it would help you to see how your current decisions will affect your future finances (and potential lifestyle).

This is just part of the process we use to help you plan for your future, adjust for changing circumstances, and stay on track to getting the outcomes you want. And it’s a key part of our ongoing service at our goal progress meetings.

Note: This case study is illustrative only and is not an estimate of the investment returns you will receive or fees and costs you will incur

How Massey Financial Advice Can Assist

At Massey Financial Advice, we support clients at every stage of the superannuation journey – whether you’re refining your existing fund, setting up a new SMSF, or reviewing your long-term strategy. Our services include:

- Helping you determine if an SMSF is the right fit for your situation.

- Assisting with superannuation rollover from existing funds.

- Providing investment strategy advice aligned to your retirement goals.

- Structuring contributions and pension strategies.

- Collaborating with your accountant or administrator to ensure compliance.

- Using financial modelling to project outcomes and test different strategies.

Our approach is always personal, never one-size-fits-all. We take the time to understand your priorities and help you make informed decisions with clarity and confidence.

Claim your FREE 25 minute call with an experienced Financial Adviser

About Adam Massey

Adam Massey, founder of Massey Financial Advice, is a Certified Financial Planner® with a Bachelor of Business and a Diploma of Financial Planning. He is married to Bron, they have 3 children and Adam has lived in Sydney, Adelaide, Canberra, Port Douglas, London and now Brisbane. He was an active committee member of The Mater Foundation and volunteers at the school tuckshop. In other words, he has more than textbook knowledge – he has the formal training and life experience to help you get the financial outcomes you want – to build wealth for retirement without sacrificing your current lifestyle.

Common Questions About SMSFs

How much super do I need to start an SMSF?

While there’s no official minimum, many professionals recommend a balance of at least $200,000 and growing to make an SMSF cost-effective when compared to retail or industry funds. You will begin to experience better cost effectiveness with balances of more than $500,000.

Can I buy property through my SMSF?

Yes, SMSFs can invest in residential or commercial property under strict conditions. The property must be for investment purposes and meet the sole purpose test – you or your family generally can’t live in the property.

Can I have an SMSF and a regular super fund at the same time?

Yes, you can maintain both. This might be useful if you’re transitioning between funds or testing out an SMSF while keeping another fund active to retain existing insurances.

What are the ongoing costs of running an SMSF?

SMSFs have setup and annual administration costs, including auditing, ATO lodgements, and potential financial or accounting advice. Costs vary depending on complexity and service providers.

What happens to my SMSF when I retire?

Your SMSF can continue into retirement and begin paying you a pension. You’ll still need to manage compliance and reporting, but your investment strategy may shift to focus more on income and capital preservation.

Why Clients Trust Massey Financial Advice?

- Certified Financial Planner® credentials and over two decades of experience.

- A clear, client-first approach – no sales pressure or product bias.

- Expertise in both traditional superannuation and SMSF strategies.

- Trusted by Brisbane clients, seeking clarity, control, and confidence.

- Plain-language advice,that makes complex decisions easier to understand.

Our focus is on delivering practical, personalised advice that works for your life – not just on paper.

Graduate

Australian Institute of Company Directors

What Others Are Saying…

Here is a small sample of what other people say about their experience dealing with Adam.

How to Explore Working Together

Would you like to know exactly how much money you’ll have when you retire based on your current plan? Would you like to know how to fast-track this plan so you can retire earlier and with more money? Would you like to know how an upcoming decision will affect this plan?