Retirement Planning

Massey Financial Advice

At Massey Financial Advice, we help professionals take control of their financial future through strategic retirement planning and practical financial modelling. Our personalised advice shows you how today’s decisions shape tomorrow’s lifestyle – so you can retire with confidence and peace of mind.

Plan Your Retirement with Confidence

Retirement is a milestone that should be approached with confidence and excitement, not uncertainty.

At Massey Financial Advice, we believe that effective retirement planning creates the freedom to live the lifestyle you envision – with financial security and peace of mind. Based in Brisbane, we partner with individuals and families to craft personalised retirement strategies that turn goals into achievable outcomes.

With tailored advice and practical financial modelling, we help you take control of your future today, so you can enjoy life beyond work tomorrow.

What Does Retirement Planning Involve?

Retirement planning goes far beyond simply growing your superannuation. A comprehensive retirement strategy covers:

- Goal setting: Defining the retirement lifestyle you want, the age you aim to retire, and the financial resources needed to support it.

- Superannuation optimisation: Structuring contributions, consolidating accounts, and managing investments within your superannuation to maximise retirement savings.

- Investment and asset allocation: Building a diversified portfolio that balances growth with risk management, aligned to your retirement time horizon.

- Healthcare and aged care planning: Preparing for future medical costs and potential aged care needs.

- Contingency planning: Ensuring your financial strategy can adapt to unexpected changes like inflation, market volatility, or life events.

Each element plays a critical role in building a retirement plan that is not only realistic but resilient.

Why Retirement Planning Matters – Especially in Brisbane

Planning for retirement is important everywhere — but Brisbane’s unique economic and lifestyle factors make it even more essential.

The cost of living in Brisbane continues to rise, with housing, healthcare, and everyday expenses placing increasing demands on retirement income. Understanding how to structure your superannuation, access government benefits, and navigate changing legislation can make a significant difference in your quality of life after you leave the workforce.

Brisbane’s diverse lifestyle opportunities – from city living to coastal or hinterland moves — also mean retirement planning should be flexible. Whether you intend to downsize, relocate, or travel extensively, a clear financial strategy can ensure your goals are within reach.

Most importantly, with Australians living longer, many retirees may spend 20–30 years in retirement. Planning thoroughly today helps ensure you enjoy every stage of that journey without unnecessary financial stress.

How Massey Financial Advice Can Support You

At Massey Financial Advice, we offer a complete range of retirement planning services designed to fit your individual needs:

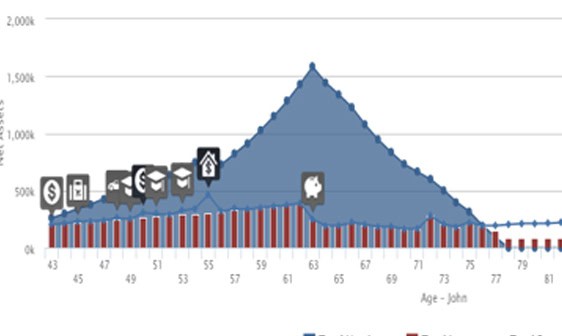

Tailored financial modelling: We provide detailed financial projections that show how today’s decisions shape tomorrow’s outcomes, giving you clear, actionable insights.

Superannuation contribution strategies: We help you structure your contributions and investment choices to maximise your superannuation balance before retirement.

Transition-to-retirement planning: Whether you want to reduce your working hours or access superannuation benefits, we guide you through transition-to-retirement strategies to ease the move into retirement.

Risk management and income protection: We help you safeguard your retirement income against market fluctuations, health issues, and other risks.

Cash flow management during retirement: We design strategies to maintain sustainable cash flow so you can enjoy life without constantly worrying about your finances.

Every plan we create is tailored to you — there are no generic solutions. We focus on practical, realistic strategies built around your values and aspirations.

- Overseas holidays every 3 years

- Replacement car every 5 years

- Private high school fees for 3 children from John’s age 49

- Purchasing a boat at age 50

- Home renovations at age 55

- Reduce their expenditure by changing or postponing some goals

- Become more disciplined with their spending (now and in the future)

- Modify their savings levels

- Adjust their investment risk

Our Approach to Retirement Planning

At Massey Financial Advice, we believe retirement planning should be as personal as your retirement dreams. Our approach is built on:

- Customised advice: Every client’s situation is unique. We take the time to understand your goals and tailor strategies accordingly.

- Plain-language communication: Financial planning doesn’t need to be complicated. We explain your options clearly so you can make informed decisions.

- Ongoing support: Retirement planning is not a one-off task. We offer regular reviews and updates to adjust your plan as life unfolds.

- A genuine partnership: We work with you over the long term, helping you stay confident and in control of your financial future.

Claim your FREE 25 minute call with an experienced Financial Adviser

About Adam Massey

Adam Massey, founder of Massey Financial Advice, is a Certified Financial Planner® with a Bachelor of Business and a Diploma of Financial Planning. He is married to Bron, they have 3 children and Adam has lived in Sydney, Adelaide, Canberra, Port Douglas, London and now Brisbane. He was an active committee member of The Mater Foundation and volunteers at the school tuckshop. In other words, he has more than textbook knowledge – he has the formal training and life experience to help you get the financial outcomes you want – to build wealth for retirement without sacrificing your current lifestyle.

Common Retirement Planning Questions

When should I start planning for retirement?

The earlier you start, the better. Ideally, planning should begin at least 10–15 years before your desired retirement age. However, it’s never too late to benefit from professional advice.

How much superannuation will I need to retire comfortably?

This depends on your desired lifestyle, expected expenses, and whether you qualify for any government support. Many Australians aim for a balance that supports 65–75% of their pre-retirement income.

What is transition to retirement and how does it work?

Transition to retirement (TTR) allows you to access a portion of your superannuation while still working, often reducing your working hours without reducing your income. It can be an effective way to ease into retirement.

How do government or legislative changes affect retirement plans?

Changes to superannuation rules, pension eligibility, or tax laws can impact your retirement strategy. Regular reviews with your financial adviser help ensure your plan remains compliant and effective.

Why Clients Trust Massey Financial Advice?

- Certified Financial Planner® qualifications, providing confidence in our knowledge and ethical standards

- Transparent and clear communication, free of unnecessary jargon

- More than two decades of experience helping individuals and families plan successfully for retirement

- A client-first philosophy, focused solely on achieving your financial goals — not selling products

Our reputation is built on trust, expertise, and a commitment to the long-term success of our clients.

Graduate

Australian Institute of Company Directors

What Others Are Saying…

Here is a small sample of what other people say about their experience dealing with Adam.

How to Explore Working Together

Would you like to know exactly how much money you’ll have when you retire based on your current plan? Would you like to know how to fast-track this plan so you can retire earlier and with more money? Would you like to know how an upcoming decision will affect this plan?