Investment Advice Brisbane

Massey Financial Advice

At Massey Financial Advice, we believe investing doesn’t have to be complex or overwhelming. Our role is to help you make informed, confident decisions with clear, practical guidance that aligns with your goals. Based in Brisbane, we provide personalised investment strategies tailored to where you are in life and where you want to go.

Why Personalised Investment Advice Matters

Sound investment advice can be one of the most powerful tools in building long-term financial security. Whether you’re starting out, looking to grow your wealth, or preparing for retirement, the right strategy makes all the difference.

While investment tips online might be easy to find, they rarely take your unique situation into account. That’s why personalised advice is essential as it ensures that your investment strategy works for your life, not someone else’s.

For example, someone saving for a first home will likely have a very different approach to someone focused on maximising retirement income. By understanding your financial position, lifestyle, risk tolerance, and long-term goals, we can design a plan that grows with you and adjusts when your circumstances change.

Personalised advice also gives you clarity in uncertain markets. Instead of reacting emotionally to short-term changes, you’ll have a strategy that keeps you focused on your bigger picture. In fact, the annual Morningstar Mind the Gap study shows investors cost themselves 1.7% a year in returns through poor behaviour.

Understanding Different Investment Options

When we help clients invest, we explain the available options clearly and in plain English. Here are some of the most common investment types:

- Shares & ETFs: Investing in shares means owning a small part of a company. ETFs (exchange-traded funds) let you invest across a range of companies or sectors, providing instant diversification.

- Managed Funds: These pooled funds are managed by professionals who invest on your behalf. They’re ideal if you want exposure to a wide variety of assets without having to pick individual investments yourself.

- Property Investment: Investing in residential or commercial property can be part of a broader strategy. It’s important to understand cash flow, borrowing, and market conditions when considering this approach, and consider diversification.

Our role is to help you choose the right mix of investments based on your needs – not to promote one type over another.

Tailoring Investment Strategies to Life Stages

Your investment strategy should evolve with you. Here’s how we approach different stages of life:

- Young Professionals: At this stage, the focus is often on building wealth. Higher-growth investments and learning to manage risk can create a strong foundation for the future. Regular investing can help build your investments.

- Families: Balancing investment growth with responsibilities like a mortgage, education costs, or family expenses requires thoughtful planning. We help design strategies that support both your present and your future.

- Pre-Retirees and Retirees: As retirement approaches, the goal often shifts from growth to stability and income. Capital preservation, tax planning, and steady income streams become key focus areas.

Wherever you are in life, we ensure your investment strategy supports what matters most to you.

The Role of a Financial Adviser

An experienced financial adviser does more than recommend investments. At Massey, we:

- Take the time to understand your goals, preferences, and concerns

- Help you select appropriate investment options and structure them efficiently

- Provide objective advice grounded in long-term thinking, not trends

- Offer ongoing support and adjustments as your life or the market changes

- Help you avoid emotional decisions, like panic selling or chasing hype

- Work with you so you feel confident about your investments and the future

We’re here for the long haul, not just to make a plan, but to help you stay on track.

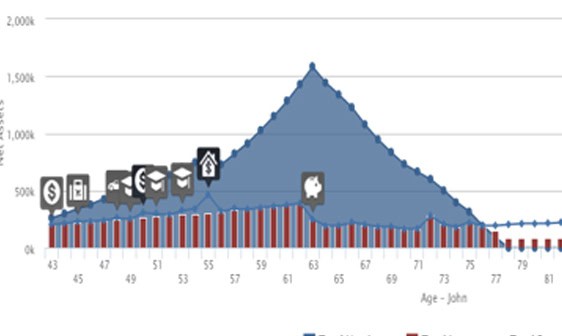

They are currently aged 43 and 41 respectively, plan to work until age 63, and according to Australian averages they can expect to live until 82 and 86.

The blue shaded area to the left of the peak shows how they are building assets while they are working. The icons and rising expenditure line show various expenses during this time which include…

- Overseas holidays every 3 years

- Replacement car every 5 years

- Private high school fees for 3 children from John’s age 49

- Purchasing a boat at age 50

- Home renovations at age 55

The spot where the blue net assets line meets the horizontal axis indicates when John and Sue will run out of money (around age 78). This gives them the opportunity to adjust their planning to achieve a different outcome. For example they could…

- Reduce their expenditure by changing or postponing some goals

- Become more disciplined with their spending (now and in the future)

- Modify their savings levels

- Adjust their investment risk

With this information, John and Sue can make decisions that help them prepare for retirement, balanced with current spending and life experiences.

Imagine having this financial modelling for your income, expenditure, and assets. Like John and Sue, it would help you to see how your current decisions will affect your future finances (and potential lifestyle).

This is just part of the process we use to help you plan for your future, adjust for changing circumstances, and stay on track to getting the outcomes you want. And it’s a key part of our ongoing service at our goal progress meetings.

Note: This case study is illustrative only and is not an estimate of the investment returns you will receive or fees and costs you will incur

Choosing the Right Investment Adviser in Brisbane

Finding the right adviser is about more than just qualifications, though they matter too. Look for someone who:

- Is a Certified Financial Planner® with relevant experience

- Is transparent about fees and puts your interests first

- Communicates clearly and answers your questions in plain language

- Offers personalised strategies, not one-size-fits-all advice

At Massey Financial Advice, we pride ourselves on delivering clear, professional guidance that reflects your values and ambitions. No jargon. No pressure. Just thoughtful advice backed by decades of experience.

Claim your FREE 25 minute call with an experienced Financial Adviser

About Adam Massey

Adam Massey, founder of Massey Financial Advice, is a Certified Financial Planner® with a Bachelor of Business and a Diploma of Financial Planning. He is married to Bron, they have 3 children and Adam has lived in Sydney, Adelaide, Canberra, Port Douglas, London and now Brisbane. He was an active committee member of The Mater Foundation and volunteers at the school tuckshop. In other words, he has more than textbook knowledge – he has the formal training and life experience to help you get the financial outcomes you want – to build wealth for retirement without sacrificing your current lifestyle.

Graduate

Australian Institute of Company Directors

What Others Are Saying…

Here is a small sample of what other people say about their experience dealing with Adam.

How to Explore Working Together

Would you like to know exactly how much money you’ll have when you retire based on your current plan? Would you like to know how to fast-track this plan so you can retire earlier and with more money? Would you like to know how an upcoming decision will affect this plan?