Insurance Advice Brisbane

Massey Financial Advice

At Massey Financial Advice, we work with Brisbane individuals and families to help them understand their insurance options and make informed decisions. Our advice is personalised, practical, and built around your broader financial goals, not around product sales.Understanding Personal Insurance and Its Importance

Personal insurance is one of the most practical and powerful ways to safeguard your financial future. It’s not just for high-income earners or business owners. It’s for anyone who wants to protect their family, their income, and their lifestyle from life’s unexpected events. Personal insurance provides a financial safety net when life doesn’t go to plan. Whether it’s an injury that stops you from working, a medical diagnosis that turns everything upside down, or the unexpected loss of a loved one, having the right insurance can ease the financial burden and provide peace of mind. Unfortunately, many Australians are underinsured, and often unaware of what cover they already hold, especially through superannuation. Others may have policies that no longer suit their stage of life. That’s why regular, professional advice matters.

Types of Personal Insurance Explained

Here are the four key types of personal insurance, explained simply:

- Life Insurance: Provides a lump sum to your beneficiaries if you pass away. It can help your family pay off debts, cover living expenses, or secure future goals like education.

- Total and Permanent Disability (TPD) Insurance: Pays a lump sum if you become permanently disabled and are unable to return to work. This can help with medical costs, rehabilitation, or long-term lifestyle adjustments.

- Trauma Insurance: Also known as critical illness cover, this pays a lump sum if you’re diagnosed with a specified serious illness, such as cancer, heart attack, or stroke, allowing you to focus on recovery, not finances. Usually, you will recover from a trauma event and be able to return to work.

- Income Protection Insurance: Replaces a portion of your regular income if you’re unable to work due to illness or injury for an extended period. This can help cover day-to-day expenses while you recover.

Each type of cover serves a different purpose. The right combination will depend on your needs, goals, and budget.

Tailoring Insurance to Your Life Stage

Your insurance needs change as your life evolves. Here’s how we tailor strategies based on where you are today:- Young Adults At this stage, premiums are lower and responsibilities are lighter, but income protection can be valuable, especially if your ability to earn is your biggest asset.

- Families: With a mortgage, children, and future expenses to think about, protecting your income and providing for your dependents becomes critical.

- Pre-Retirees As you approach retirement, it’s time to reassess your cover. You may be reducing debt, shifting focus to estate planning, or managing self-managed superannuation funds (SMSFs).

- Pre-RetireesYou may no longer need income protection, but it’s important to review legacy planning and make sure any existing cover still makes sense for your situation.

The Role of Massey Financial Advice in Your Insurance Planning

At Massey Financial Advice, we see insurance as part of the bigger picture – your whole financial strategy. Here’s how we help:

- Review your current policies and highlight any gaps, overlaps, or outdated cover

- Clarify what insurance you already have (especially through super)

- Recommend the right type and level of cover for your situation and goals

- Coordinate insurance with your investment, retirement, and estate planning

- Update your strategy as your life changes

Our advice is always clear, client-first, and based on your specific needs.

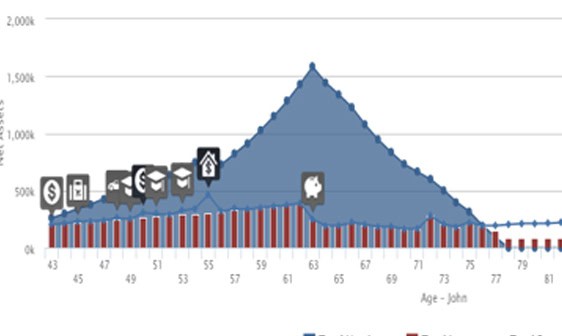

- Overseas holidays every 3 years

- Replacement car every 5 years

- Private high school fees for 3 children from John’s age 49

- Purchasing a boat at age 50

- Home renovations at age 55

- Reduce their expenditure by changing or postponing some goals

- Become more disciplined with their spending (now and in the future)

- Modify their savings levels

- Adjust their investment risk

Common Questions About Personal Insurance

Do I still need insurance if I have some through superannuation?

Possibly, but it depends on your circumstances. Insurance through super can be limited in cover or may not suit your specific needs. We help assess the policy definitions and whether it’s enough.

How much cover is enough for my situation?

That depends on your income, debts, dependents, and future goals. We can model different scenarios and guide you toward a suitable level of protection.

What’s the difference between trauma and income protection insurance?

Trauma pays a lump sum if you’re diagnosed with a specific illness. Income protection replaces part of your income if you’re unable to work due to illness or injury.

Can my insurance premiums change over time?

Yes. Some policies have stepped premiums that increase with age, while others offer level premiums. We’ll explain the pros and cons.

Can I adjust my cover later?

Absolutely. As life evolves, so should your cover. We help you review and adjust your insurance as needed.

About Adam Massey

Adam Massey, founder of Massey Financial Advice, is a Certified Financial Planner® with a Bachelor of Business and a Diploma of Financial Planning. He is married to Bron, they have 3 children and Adam has lived in Sydney, Adelaide, Canberra, Port Douglas, London and now Brisbane. He was an active committee member of The Mater Foundation and volunteers at the school tuckshop. In other words, he has more than textbook knowledge – he has the formal training and life experience to help you get the financial outcomes you want – to build wealth for retirement without sacrificing your current lifestyle.

Graduate

Australian Institute of Company Directors

Why Choose Massey Financial Advice for Your Insurance Needs

- Certified Financial Planner® with more than 20 years of experience

- Trusted by Brisbane families for tailored, long-term support

- Clear, no-jargon advice that puts your interests first

- Advice integrated with your broader financial strategy, not product sales

- Genuine, client-first focus with a transparent approach

We’re here to guide you, not sell to you.

Claim your FREE 25 minute call with an experienced Financial Adviser

What Others Are Saying…

Here is a small sample of what other people say about their experience dealing with Adam.

How to Explore Working Together

Would you like to know exactly how much money you’ll have when you retire based on your current plan? Would you like to know how to fast-track this plan so you can retire earlier and with more money? Would you like to know how an upcoming decision will affect this plan?