Estate Planning Services Brisbane

Massey Financial Advice

At Massey Financial Advice, we work with clients across Brisbane to ensure their estate plans are aligned with their financial goals, family needs, and personal values. Our role is to simplify the process and give you confidence that your wishes will be honoured.

What Is Estate Planning – and Why Does It Matter?

Estate planning is about making smart, thoughtful decisions today to protect the people and things that matter most tomorrow. It’s not just something for the wealthy or the retired – it’s a crucial step for anyone who wants peace of mind, clarity, and control over how their assets are managed in the future.

Estate planning is more than just writing a will. It’s a comprehensive process that ensures your financial and personal wishes are carried out if you’re no longer able to make decisions or after you pass away. A well-structured estate plan helps protect your loved ones from unnecessary legal complications and emotional stress.

With the right plan in place, you can clearly communicate how your assets should be distributed, who should manage your affairs, and how you’d like to be cared for if you’re unable to make decisions yourself. It’s about peace of mind – for you, and for those you leave behind.

Who Should Have an Estate Plan?

Estate planning isn’t just for those with large estates or complex finances. In fact, many Australians benefit from having one in place. You should consider an estate plan if you are:

- A parent with dependent children.

- A business owner or someone with significant financial responsibilities.

- A property or asset owner.

- A member of a self-managed superannuation fund (SMSF).

- Someone who wants to document specific medical or financial instructions.

Estate planning is about protecting your family, maintaining control, and making sure your wishes are carried out – regardless of your age or wealth.

Key Estate Planning Tools – Explained Simply

Several key documents and tools help bring your estate plan to life. Here’s a quick overview:

- Will – Directs how your assets should be distributed when you pass away and names an executor to manage your estate.

- Enduring Power of Attorney (EPOA) – Appoints someone you trust to make financial or legal decisions on your behalf if you lose capacity.

- Advance Health Directive (AHD) – Documents your medical treatment preferences if you’re unable to speak for yourself.

- Testamentary Trust – A trust established through your will to manage and protect assets for beneficiaries, particularly useful in complex family or financial situations.

- Superannuation Beneficiary Nomination – Determines who receives your super and whether it’s handled tax-effectively.

Each of these elements plays a role in ensuring your intentions are clearly defined and legally respected.

Estate Planning and Superannuation – Why They Must Work Together

One of the most common misconceptions is that your superannuation automatically forms part of your estate. In reality, your super sits outside your will unless you take steps to align it. If beneficiary nominations aren’t correctly structured, your super may be distributed in ways that don’t match your wishes – or trigger unnecessary tax for your beneficiaries.

This is where financial advice becomes essential. At Massey Financial Advice, we help ensure your estate plan and superannuation strategy are working in harmony. Whether you’re in an industry fund or managing your own SMSF, we guide you through the best way to structure your super to reflect your legacy goals.

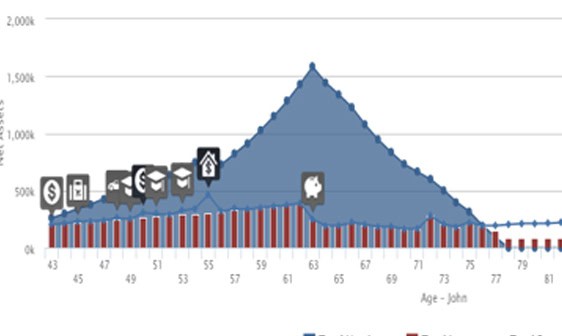

They are currently aged 43 and 41 respectively, plan to work until age 63, and according to Australian averages they can expect to live until 82 and 86.

The blue shaded area to the left of the peak shows how they are building assets while they are working. The icons and rising expenditure line show various expenses during this time which include…

- Overseas holidays every 3 years

- Replacement car every 5 years

- Private high school fees for 3 children from John’s age 49

- Purchasing a boat at age 50

- Home renovations at age 55

The spot where the blue net assets line meets the horizontal axis indicates when John and Sue will run out of money (around age 78). This gives them the opportunity to adjust their planning to achieve a different outcome. For example they could…

- Reduce their expenditure by changing or postponing some goals

- Become more disciplined with their spending (now and in the future)

- Modify their savings levels

- Adjust their investment risk

With this information, John and Sue can make decisions that help them prepare for retirement, balanced with current spending and life experiences.

Imagine having this financial modelling for your income, expenditure, and assets. Like John and Sue, it would help you to see how your current decisions will affect your future finances (and potential lifestyle).

This is just part of the process we use to help you plan for your future, adjust for changing circumstances, and stay on track to getting the outcomes you want. And it’s a key part of our ongoing service at our goal progress meetings.

Note: This case study is illustrative only and is not an estimate of the investment returns you will receive or fees and costs you will incur

How Massey Financial Advice Can Help

Here’s how we support you:

- Review your existing estate documents and ensure they align with your financial goals./li>

- Help clarify your intentions around asset distribution, family needs, and charitable giving.

- Work in collaboration with legal professionals or refer you to trusted specialists.

- Use financial modelling to forecast how different decisions could impact your beneficiaries.

- Provide ongoing advice and plan updates as your family, finances, or life circumstances evolve.

Our role is to simplify complexity and ensure your legacy is protected with care and clarity.

Claim your FREE 25 minute call with an experienced Financial Adviser

About Adam Massey

Adam Massey, founder of Massey Financial Advice, is a Certified Financial Planner® with a Bachelor of Business and a Diploma of Financial Planning. He is married to Bron, they have 3 children and Adam has lived in Sydney, Adelaide, Canberra, Port Douglas, London and now Brisbane. He was an active committee member of The Mater Foundation and volunteers at the school tuckshop. In other words, he has more than textbook knowledge – he has the formal training and life experience to help you get the financial outcomes you want – to build wealth for retirement without sacrificing your current lifestyle.

Common Questions About Estate Planning

What happens if I die without a will?

If you pass away without a will, your estate is distributed according to a legal formula – which may not align with your personal wishes. It can also create additional stress and delays for your family.

Can my super be included in my will?

Super generally doesn’t form part of your estate unless you specifically direct it to. To control how your super is handled, you need to make a valid beneficiary nomination with your super fund.

How often should I update my estate plan?

We recommend reviewing your estate plan every few years, or after major life changes such as marriage, divorce, having children, or significant financial changes.

What’s the difference between a will and a power of attorney?

A will takes effect after you pass away. A power of attorney applies while you’re alive but unable to make decisions due to illness, injury, or incapacity.

Can Massey still help if I already have a lawyer?

Yes. We work alongside your solicitor to ensure your legal documents and financial strategies are aligned. Estate planning works best when legal and financial advice come together.

Why Clients Choose Massey Financial Advice?

- Certified Financial Planner® credentials with over two decades of experience.

- A clear, client-first approach – always focused on your values and goals.

- Personalised advice, not templated or transactional.

- Strong local ties, proudly supporting Brisbane individuals and families.

- Plain-language explanations, that empowers you to make confident decisions.

We’re here to provide clarity, structure, and lasting peace of mind.

Graduate

Australian Institute of Company Directors

What Others Are Saying…

Here is a small sample of what other people say about their experience dealing with Adam.

How to Explore Working Together

Would you like to know exactly how much money you’ll have when you retire based on your current plan? Would you like to know how to fast-track this plan so you can retire earlier and with more money? Would you like to know how an upcoming decision will affect this plan?