10 Years to Retirement

Massey Financial Advice

At Massey Financial Advice, we work with individuals and couples across Brisbane to help them navigate this critical decade with clarity and purpose. We bring together all the pieces – superannuation, debt, cashflow, insurance, estate planning, and more to create a retirement plan that supports your ideal lifestyle.

Why the 10 Year Mark Matters

The earlier you prepare, the more confident you’ll feel stepping into retirement. Starting at the 10 year mark allows you to course-correct if needed, take advantage of contribution strategies, and make smart decisions that maximise your retirement savings and your lifestyle options.

This is also when questions start to arise:

- Will I have enough?

- Can I clear my debt in time?

- What lifestyle can I afford?

- Should I consolidate my super?

- When should I stop working, and how?

Having expert guidance can help you answer these questions with certainty and shape a plan that works for you.

What You Should Focus On in the Last 10 Years

Retirement planning isn’t just about money. It’s about aligning your finances with your goals, health, family needs and values. Here are the key areas we help our clients focus on:

1. Lending and Banking

Clearing or managing debt is a major priority. We help you:

- Review and prioritise loans.

- Create a plan to pay down debt by retirement.

- Optimise your banking structure for simplicity and efficiency.

- Understand your credit behaviour and reduce unnecessary interest costs.

2. Cashflow and Lifestyle

Understanding how much you need in retirement starts with understanding what you spend now. We help you:

- Determine current and future living expenses.

- Adjust your spending to reflect future lifestyle goals.

- Build a cash buffer for unexpected costs like medical expenses or home maintenance.

- Allocate any surplus income in an efficient manner to assist with future plans.

3. Superannuation

Super is one of your most powerful retirement tools. We’ll help you:

- Consolidate accounts where appropriate.

- Review your investments and risk level.

- Maximise contributions while minimising tax.

- Explore transition-to-retirement strategies.

4. Insurance

As life changes, so should your cover. We review:

- Whether your current personal insurance is still appropriate.

- Opportunities to reduce premiums and redirect savings.

- The impact of insurance on your super balance.

- Timing for scaling back or maintaining cover.

5. Work and Income Planning

We help you decide:

- Whether to reduce hours, change careers, or retire completely.

- What your income needs will be, and how long your savings will last.

- How to manage redundancy or early exit risks.

- Whether work can remain a fulfilling part of your lifestyle.

6. Health, Lifestyle and Estate Planning

Good financial planning includes the big picture. We support you in:

- Maintaining life balance so you can enjoy retirement in good health.

- Ensuring your estate plan protects your loved ones.

- Preparing for both the expected and the unexpected.

Our 10 Years to Retirement Approach

At Massey Financial Advice, we guide you through a practical, personalised planning process – free of judgement and full of clarity.

We start with a conversation to understand your goals, then build a plan that bridges where you are now with where you want to be.

Our goal is simple: help you retire with confidence, not guesswork. Whether retirement is five, ten, or even more years away, the right plan can make all the difference.

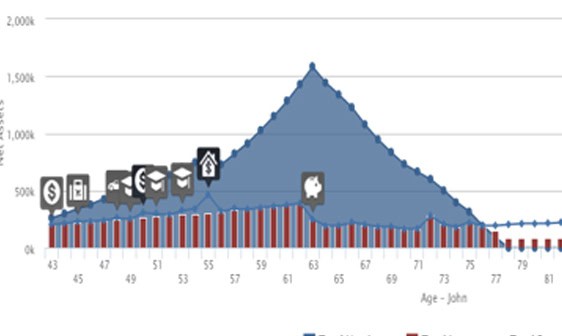

They are currently aged 43 and 41 respectively, plan to work until age 63, and according to Australian averages they can expect to live until 82 and 86.

The blue shaded area to the left of the peak shows how they are building assets while they are working. The icons and rising expenditure line show various expenses during this time which include…

- Overseas holidays every 3 years

- Replacement car every 5 years

- Private high school fees for 3 children from John’s age 49

- Purchasing a boat at age 50

- Home renovations at age 55

The spot where the blue net assets line meets the horizontal axis indicates when John and Sue will run out of money (around age 78). This gives them the opportunity to adjust their planning to achieve a different outcome. For example they could…

- Reduce their expenditure by changing or postponing some goals

- Become more disciplined with their spending (now and in the future)

- Modify their savings levels

- Adjust their investment risk

With this information, John and Sue can make decisions that help them prepare for retirement, balanced with current spending and life experiences.

Imagine having this financial modelling for your income, expenditure, and assets. Like John and Sue, it would help you to see how your current decisions will affect your future finances (and potential lifestyle).

This is just part of the process we use to help you plan for your future, adjust for changing circumstances, and stay on track to getting the outcomes you want. And it’s a key part of our ongoing service at our goal progress meetings.

Note: This case study is illustrative only and is not an estimate of the investment returns you will receive or fees and costs you will incur

Common Questions About Retirement Planning

What if I still have debt in retirement?

We help you weigh up options such as downsizing, restructuring loans, or timing asset sales to minimise risk and maximise lifestyle outcomes.

How much super do I need to retire?

It depends on the life you want to live. We help you calculate your target based on your real spending goals and design a plan to reach it.

Can I access my super while still working?

Yes, with a transition-to-retirement (TTR) strategy, you may be able to draw income from your super while continuing to work and contribute.

What happens if I retire earlier than planned?

We help you build in flexibility so your plan can adapt to unexpected health, family, or work changes.

Is it too late to start planning?

Not at all. Whether you’re 5 or 15 years out from retirement, the best time to start is now.

About Adam Massey

Adam Massey, founder of Massey Financial Advice, is a Certified Financial Planner® with a Bachelor of Business and a Diploma of Financial Planning. He is married to Bron, they have 3 children and Adam has lived in Sydney, Adelaide, Canberra, Port Douglas, London and now Brisbane. He was an active committee member of The Mater Foundation and volunteers at the school tuckshop. In other words, he has more than textbook knowledge – he has the formal training and life experience to help you get the financial outcomes you want – to build wealth for retirement without sacrificing your current lifestyle.

Graduate

Australian Institute of Company Directors

Why Choose Massey Financial Advice ?

✔ Practical, down-to-earth advice with no judgement

✔ Specialised in helping people prepare for retirement

✔ Personalised financial strategies

✔ Clear, structured guidance across all areas of planning

✔ Proudly Brisbane-based and client-focused

Retirement should be something you look forward to – not worry about. If you’re around 10 years out, now is the time to take control of your financial future. Let’s start planning today. Contact Massey Financial Advice to book your complimentary initial consultation and take the first step toward your ideal retirement.

What Others Are Saying…

Here is a small sample of what other people say about their experience dealing with Adam.

How to Explore Working Together

Would you like to know exactly how much money you’ll have when you retire based on your current plan? Would you like to know how to fast-track this plan so you can retire earlier and with more money? Would you like to know how an upcoming decision will affect this plan?