Commencing Retirement

Massey Financial Advice

At Massey Financial Advice, we guide individuals and couples in Brisbane through the financial side of life after work. Our role is to help you feel confident and in control, knowing your finances are structured to support your goals for the years ahead.

Why Financial Advice Matters in Retirement

Starting retirement isn’t the end of your financial planning journey – it’s the beginning of a new phase that deserves just as much attention and care. When the regular pay cheque stops, managing your money well becomes essential to living the lifestyle you’ve worked so hard to achieve.

Retirement brings freedom, but it also brings new financial questions. You might be asking:

- Will my savings last the distance?

- What’s the best way to draw income from my super?

- How do I structure my finances to reduce tax and stress?

- When and how should I apply for the Age Pension?

- What happens if I face unexpected medical or aged care costs?

These aren’t simple questions and the answers are different for everyone. That’s where expert, personalised advice from a Certified Financial Planner® can make a real difference. We take the time to understand your goals and concerns, and then build a practical, tax-effective plan that works for the retirement you want to live.

What We Help With Once You’re Retired

Retirement Income Strategy

One of the most important decisions in retirement is how to turn your savings into a reliable income. We help you structure your superannuation and other assets in a way that provides flexibility, tax efficiency, and peace of mind. Whether you’re receiving the Age Pension, using an account-based pension, or relying on other investments, we help you make smart, informed decisions.

Cashflow and Lifestyle Planning

Your spending habits change in retirement and your financial plan should change too. We help you create a cashflow strategy that supports the lifestyle you want, while still allowing for future costs like health care, travel, or home maintenance. It’s about making your money work for you now and in the years to come.

Estate and Aged Care Considerations

It’s important to know your loved ones will be looked after when the time comes. We help ensure your estate plan is up to date, your superannuation nominations are correctly structured, and you have a clear plan if aged care becomes a consideration. These are sensitive topics, but they’re too important to leave to chance.

Our Approach to Supporting You in Retirement

At Massey Financial Advice, our focus is on helping you enjoy retirement with confidence. That means:

- Understanding your unique goals and lifestyle plans

- Providing clear, practical strategies tailored to your needs

- Reviewing and adjusting your plan as life changes

- Working with your accountant, solicitor, or aged care provider when needed

Retirement should feel like a reward, not a risk. With the right guidance, it can be everything you hoped for.

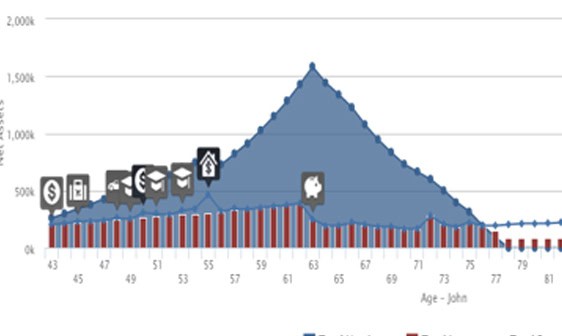

They are currently aged 43 and 41 respectively, plan to work until age 63, and according to Australian averages they can expect to live until 82 and 86.

The blue shaded area to the left of the peak shows how they are building assets while they are working. The icons and rising expenditure line show various expenses during this time which include…

- Overseas holidays every 3 years

- Replacement car every 5 years

- Private high school fees for 3 children from John’s age 49

- Purchasing a boat at age 50

- Home renovations at age 55

The spot where the blue net assets line meets the horizontal axis indicates when John and Sue will run out of money (around age 78). This gives them the opportunity to adjust their planning to achieve a different outcome. For example they could…

- Reduce their expenditure by changing or postponing some goals

- Become more disciplined with their spending (now and in the future)

- Modify their savings levels

- Adjust their investment risk

With this information, John and Sue can make decisions that help them prepare for retirement, balanced with current spending and life experiences.

Imagine having this financial modelling for your income, expenditure, and assets. Like John and Sue, it would help you to see how your current decisions will affect your future finances (and potential lifestyle).

This is just part of the process we use to help you plan for your future, adjust for changing circumstances, and stay on track to getting the outcomes you want. And it’s a key part of our ongoing service at our goal progress meetings.

Note: This case study is illustrative only and is not an estimate of the investment returns you will receive or fees and costs you will incur

Common Questions About Retirement

Is it too late to get advice now that I’m retired?

Not at all. Whether you’re just starting retirement or have been retired for years, the right advice can help you improve your financial position and make smarter decisions.

How can I make sure I don’t run out of money?

We use financial modelling to project how long your savings will last and explore strategies to make your money go further without sacrificing your lifestyle.

Do I need to review my super now that I’ve retired?

Yes. Retirement is the perfect time to check your investment mix, income strategy, and pension arrangements to ensure they suit your new phase of life.

Can I still invest while retired?

Absolutely. With the right approach, you can balance growth with security and continue to build wealth, even in retirement.

About Adam Massey

Adam Massey, founder of Massey Financial Advice, is a Certified Financial Planner® with a Bachelor of Business and a Diploma of Financial Planning. He is married to Bron, they have 3 children and Adam has lived in Sydney, Adelaide, Canberra, Port Douglas, London and now Brisbane. He was an active committee member of The Mater Foundation and volunteers at the school tuckshop. In other words, he has more than textbook knowledge – he has the formal training and life experience to help you get the financial outcomes you want – to build wealth for retirement without sacrificing your current lifestyle.

Graduate

Australian Institute of Company Directors

Why Choose Massey Financial Advice?

✔ Down-to-earth advice, with no jargon or judgement

✔ Trusted guidance tailored to retirement life

✔ Personalised service with strong local connections

✔ Financial clarity, structure, and long-term peace of mind

Just because you’ve retired doesn’t mean your finances should be left on autopilot. If you want confidence that your money will last, and support to make the most of this next chapter, we’re here to help.

Get in touch with Massey Financial Advice to book your complimentary consultation and make retirement everything it should be.

What Others Are Saying…

Here is a small sample of what other people say about their experience dealing with Adam.

How to Explore Working Together

Would you like to know exactly how much money you’ll have when you retire based on your current plan? Would you like to know how to fast-track this plan so you can retire earlier and with more money? Would you like to know how an upcoming decision will affect this plan?