Inheritance Adviser Brisbane

Massey Financial Advice

At Massey Financial Advice, we work with clients across Brisbane who have recently received (or are expecting) an inheritance and want to make wise, considered decisions. Our role is to help you honour the legacy left to you while making confident, practical choices for your future.

Why Inheritance Advice Matters

An inheritance can be a life-changing gift but it can also feel overwhelming. Whether it’s a lump sum, property, or investment portfolio, receiving an inheritance often comes with big questions, financial uncertainty, and emotional complexity.

When wealth arrives suddenly, it’s easy to feel pressure to act quickly. You might be wondering:

- Should I invest, pay off debt, or add it to super?

- Will this affect my tax position or benefits?

- What’s the smartest way to make it last?

- How do I manage family expectations or avoid making emotional decisions?

The truth is, there’s no one-size-fits-all answer. That’s why personalised financial advice is so important. We help you pause, take stock, and move forward with clarity and confidence, not panic or guilt.

What We Help With

Creating a Calm, Clear Plan

Our first step is to give you space. We often recommend taking time before making any major financial decisions. Once you’re ready, we begin by reviewing your full financial picture and understanding your personal goals.

We then help you:

- Identify short-term needs and set aside a cash buffer.

- Clarify your values and lifestyle goals so your inheritance supports them.

- Avoid reactive decisions and structure your funds with purpose.

Strategic Advice for Your Inheritance

Once you’re ready to move forward, we develop a strategy that aligns with your financial situation and long-term goals. Depending on your needs, this might include:

- Paying off high-interest debt.

- Reviewing your cash flow structure

- Investing in a diversified portfolio.

- Making super contributions (within allowable limits).

- Setting up income streams or financial buffers for future plans.

We also ensure that any decisions complement your retirement planning, existing investment structures, and risk preferences.

Keeping It Working for You

Inheriting wealth is one thing but preserving it is another. We help ensure your new financial position stays aligned with your life and evolves with it. This includes:

- Structuring investments for ongoing returns and sustainability.

- Reviewing any impacts on government entitlements or tax planning.

- Regular check-ins and updates as your needs or markets change.

Our Approach

At Massey Financial Advice, we understand that an inheritance often comes with emotion, uncertainty, and responsibility. That’s why we take a supportive, down-to-earth approach, helping you make clear, smart financial decisions without pressure or complexity.

We focus purely on the financial side, not legal matters, and work in partnership with your accountant or solicitor as needed. Our aim is simple: to help you turn your inheritance into something lasting and meaningful.

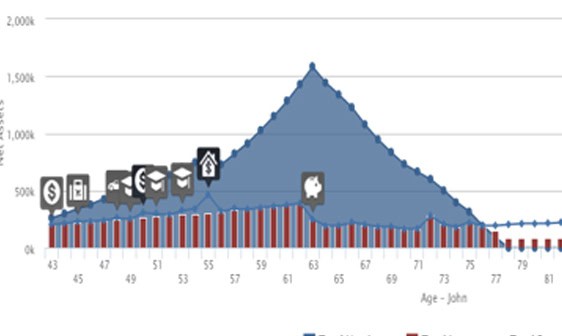

They are currently aged 43 and 41 respectively, plan to work until age 63, and according to Australian averages they can expect to live until 82 and 86.

The blue shaded area to the left of the peak shows how they are building assets while they are working. The icons and rising expenditure line show various expenses during this time which include…

- Overseas holidays every 3 years

- Replacement car every 5 years

- Private high school fees for 3 children from John’s age 49

- Purchasing a boat at age 50

- Home renovations at age 55

The spot where the blue net assets line meets the horizontal axis indicates when John and Sue will run out of money (around age 78). This gives them the opportunity to adjust their planning to achieve a different outcome. For example they could…

- Reduce their expenditure by changing or postponing some goals

- Become more disciplined with their spending (now and in the future)

- Modify their savings levels

- Adjust their investment risk

With this information, John and Sue can make decisions that help them prepare for retirement, balanced with current spending and life experiences.

Imagine having this financial modelling for your income, expenditure, and assets. Like John and Sue, it would help you to see how your current decisions will affect your future finances (and potential lifestyle).

This is just part of the process we use to help you plan for your future, adjust for changing circumstances, and stay on track to getting the outcomes you want. And it’s a key part of our ongoing service at our goal progress meetings.

Note: This case study is illustrative only and is not an estimate of the investment returns you will receive or fees and costs you will incur

Common Questions About Inheritance

Australia doesn’t have an inheritance tax, but some inherited assets, like superannuation or property, may trigger tax implications. We help you understand and plan around these.

Can I contribute inheritance money to my super?

Potentially. We guide you on contribution caps, eligibility, and whether it’s the best fit for your broader financial strategy.

What if I don’t want to make any big decisions right now?

That’s okay, in fact, we often recommend a “cooling-off” period. We can help you protect the funds in the short term until you’re ready to plan.

Will this impact my Age Pension or benefits?

It could. We’ll help you assess the impact on your asset and income tests and identify the best way to manage this.

About Adam Massey

Adam Massey, founder of Massey Financial Advice, is a Certified Financial Planner® with a Bachelor of Business and a Diploma of Financial Planning. He is married to Bron, they have 3 children and Adam has lived in Sydney, Adelaide, Canberra, Port Douglas, London and now Brisbane. He was an active committee member of The Mater Foundation and volunteers at the school tuckshop. In other words, he has more than textbook knowledge – he has the formal training and life experience to help you get the financial outcomes you want – to build wealth for retirement without sacrificing your current lifestyle.

Graduate

Australian Institute of Company Directors

Why Choose Massey Financial Advice for Inheritance Advice?

✔ Specialist advice for managing sudden wealth or inheritance

✔ Empathetic, pressure-free support from a trusted Brisbane adviser.

✔ Personalised financial planning that aligns with your values

✔ Practical strategies and regular reviews to keep you on track

We’re here to guide you, not sell to you.

Claim your FREE 25 minute call with an experienced Financial Adviser

What Others Are Saying…

Here is a small sample of what other people say about their experience dealing with Adam.

How to Explore Working Together

Would you like to know exactly how much money you’ll have when you retire based on your current plan? Would you like to know how to fast-track this plan so you can retire earlier and with more money? Would you like to know how an upcoming decision will affect this plan?