Massey Financial Advice

Financial Adviser The Gap

Massey Financial Advice uses Practical Financial Modelling to help busy professionals see the future results of your current decisions so you can enjoy a better life now and in the future

Massey Financial Advice – Bespoke Financial Guidance with a Client-First Approach

With over 20 years of experience in the financial services industry, Massey Financial Advice has earned a reputation as a premier provider of bespoke financial advice in The Gap.

Our firm’s success is built on a steadfast client-first philosophy and a commitment to excellence. We pride ourselves on delivering clear, strategic guidance that empowers you to make confident decisions about your future.

Whether you’re planning for retirement, managing investments, or safeguarding your family’s financial well-being, our seasoned advisers are here to provide professional support tailored to your needs.

Why Choose Massey Financial Advice?

Our commitment to transparency, personalisation, and innovative modelling gives you clarity and peace of mind. With Massey Financial Advice, you have a trusted partner dedicated to helping you achieve financial security and success.

- Unwavering Transparency: We believe in complete honesty and openness. From our fee structure to our advice process, everything is transparent. You will always know how and why we make recommendations. Our advisers act in your best interest at all times, offering advice with no hidden agendas or surprises.

- Personalised Strategies: No two clients are the same. We take the time to understand your unique circumstances, goals, and values before crafting a financial plan. This personalised approach means your strategy is customised to your life – truly bespoke advice that aligns with what matters most to you. You get solutions designed around your individual objectives, not off-the-shelf products.

- Advanced Financial Modelling: As part of our planning process, we utilise cutting-edge financial modelling software to forecast and visualise your financial future. This practical modelling acts like a financial roadmap – illustrating how decisions you make today (such as increasing superannuation contributions, reducing debt, or making a major purchase) could impact your wealth tomorrow. By “seeing” potential outcomes, you can plan with confidence and make well-informed choices.

Financial Services for The Gap Clients

We offer a comprehensive range of financial planning and wealth management services to clients in The Gap. No matter what stage of life you’re in or what goals you’re pursuing, our team can provide expert advice in areas including:

- Superannuation Advice – Helping you navigate superannuation rules and optimise your retirement savings.

- Retirement Planning – Developing strategies so you can retire comfortably and on your own terms.

- Ten Years to Retirement – Specialised planning for those in the decade before retirement, to maximise wealth and minimise stress.

- Commencing Retirement – Guidance as you transition from work to retirement, ensuring your finances are set up for a smooth start to this new chapter.

- During Retirement – Ongoing advice to manage your income, investments, and lifestyle throughout your retirement years.

- Investing / Debt Management – Strategies for growing your wealth through prudent investments and effective debt reduction or structuring.

- Estate Planning and Personal Insurance – Protecting your legacy and loved ones with appropriate estate plans, wills, and insurance coverage (life, income protection, etc.).

- Cash Flow and Budgeting Advice – Helping you control spending, plan budgets, and maintain healthy cash flow for today and the future.

- Transition to Retirement – Implementing transition-to-retirement strategies (TTR) that allow you to reduce work hours or access superannuation benefits as you approach retirement age.

Each of these services is delivered with the utmost professionalism and care. Our advisers stay current with Australia’s financial regulations and market trends, ensuring that The Gap clients receive advice that is not only personalised but also up-to-date and compliant. Whether you need a one-off consultation or a holistic long-term financial plan, we have the expertise to assist you.

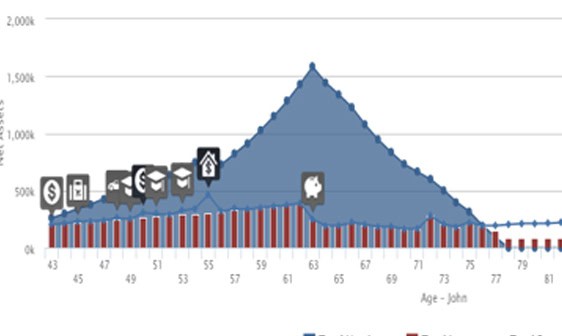

They are currently aged 43 and 41 respectively, plan to work until age 63, and according to Australian averages they can expect to live until 82 and 86.

The blue shaded area to the left of the peak shows how they are building assets while they are working. The icons and rising expenditure line show various expenses during this time which include…

- Overseas holidays every 3 years

- Replacement car every 5 years

- Private high school fees for 3 children from John’s age 49

- Purchasing a boat at age 50

- Home renovations at age 55

The spot where the blue net assets line meets the horizontal axis indicates when John and Sue will run out of money (around age 78). This gives them the opportunity to adjust their planning to achieve a different outcome. For example they could…

- Reduce their expenditure by changing or postponing some goals

- Become more disciplined with their spending (now and in the future)

- Modify their savings levels

- Adjust their investment risk

With this information, John and Sue can make decisions that help them prepare for retirement, balanced with current spending and life experiences.

Imagine having this financial modelling for your income, expenditure, and assets. Like John and Sue, it would help you to see how your current decisions will affect your future finances (and potential lifestyle).

This is just part of the process we use to help you plan for your future, adjust for changing circumstances, and stay on track to getting the outcomes you want. And it’s a key part of our ongoing service at our goal progress meetings.

Note: This case study is illustrative only and is not an estimate of the investment returns you will receive or fees and costs you will incur

We Make Advice as Easy as

1

Claim your FREE 25 minute call with an experienced Financial Adviser

2

We find out about you and put together strategies to help you, making sure you understand them

3

We prepare the paperwork to help you implement any changes and check in to ensure your success

About Adam Massey

Adam Massey, founder of Massey Financial Advice, is a Certified Financial Planner® with a Bachelor of Business and a Diploma of Financial Planning. He is married to Bron, they have 3 children and Adam has lived in Sydney, Adelaide, Canberra, Port Douglas, London and now Brisbane. He was an active committee member of The Mater Foundation and volunteers at the school tuckshop. In other words, he has more than textbook knowledge – he has the formal training and life experience to help you get the financial outcomes you want – to build wealth for retirement without sacrificing your current lifestyle.

Personalised Approach to Wealth Management

At Massey Financial Advice, wealth management is far more than numbers on a balance sheet – it’s about building a relationship and understanding what wealth means to you. Our The Gap advisers take a personalised approach, working closely with each client to truly understand your life story, values, and aspirations.

We begin by listening: learning about your family situation, career, lifestyle goals, and what keeps you awake at night. By appreciating the full picture of your life, we can align your financial plan with your personal goals and core values.

This relationship-driven approach fosters trust and ensures that our advice remains focused on you. We recognise that financial goals can be deeply personal – whether it’s retiring early to spend time with grandchildren, buying a home in The Gap, funding your children’s education, or simply achieving peace of mind about the future. Our team’s mission is to help you reach those goals with tailored strategies that fit your unique circumstances.

We also understand that life is dynamic; as your situation or objectives change, we remain by your side, ready to adjust your plan and keep you on track. With regular reviews and open communication, we ensure your financial strategy continues to serve your best interests over the long term.

By combining technical expertise with genuine care and understanding, Massey Financial Advice delivers a high-trust advisory experience. Our clients know they have a dedicated partner who will guide them through life’s financial decisions with professionalism, empathy, and insight.

Ready to Secure Your Financial Future?

Take the next step towards financial confidence. If you’re in The Gap and seeking a trustworthy, expert financial adviser, we invite you to experience the Massey Financial Advice difference.

Contact our team today to book a confidential, no-obligation meeting with our experienced adviser.

During this initial consultation, we’ll discuss your needs, answer your questions, and outline how our tailored approach can help you achieve your financial goals.

Graduate

Australian Institute of Company Directors

What Others Are Saying…

Here is a small sample of what other people say about their experience dealing with Adam.

How to Explore Working Together

Would you like to know exactly how much money you’ll have when you retire based on your current plan? Would you like to know how to fast-track this plan so you can retire earlier and with more money? Would you like to know how an upcoming decision will affect this plan?